Credit derivatives can be divided into two broad categories:

- Transactions where credit protection is bought and sold; and

- Total return swaps.

Let’s have a closer look at each of these categories:

- Transactions where Credit Protection is bought and sold

(A) Credit Default Swap (CDS)

It is a bilateral derivative contract on one or more reference assets in which the protection buyer pays a fee through the life of the contract in return for a credit event payment by the protection seller following a credit event of the reference entities. In most instances, the Protection Buyer makes quarterly payments to the Protection Seller. The periodic payment is typically expressed in annualized basis points of a transaction’s notional amount. In the instance that no pre-specified credit event occurs during the life of the transaction, the Protection Seller receives the periodic payment in compensation for assuming the credit risk on the Reference Entity/Obligation. Conversely, in the instance that any one of the credit events occurs during the life of the transaction, the Protection Buyer will receive a credit event payment, which will depend upon whether the terms of a particular CDS call for a physical or cash settlement. With few exceptions, the legal framework of a CDS – that is, the documentation evidencing the transaction – is based on a confirmation document and legal definitions set forth by the International Swaps and Derivatives Association, Inc. (ISDA).

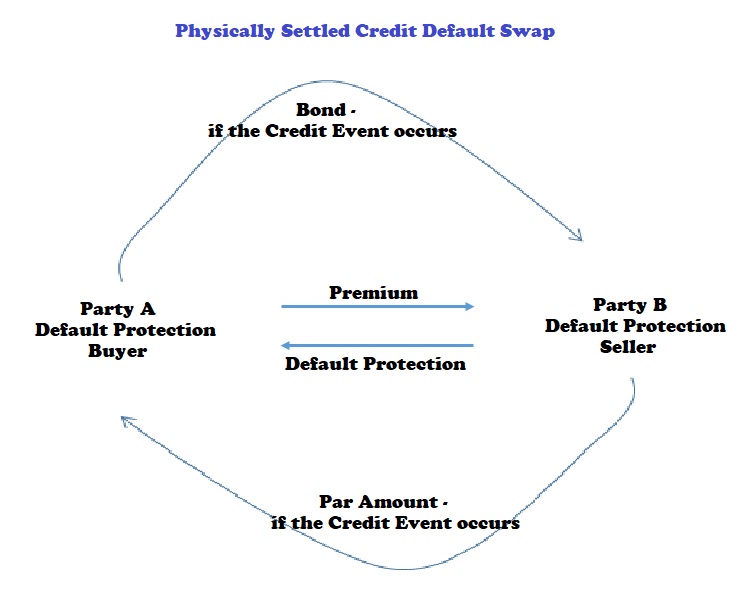

If a Credit Event occurs and physical settlement applies; the transaction shall accelerate and Protection Buyer shall deliver the Deliverable Obligations to Protection Seller against payment of a pre-agreed amount.

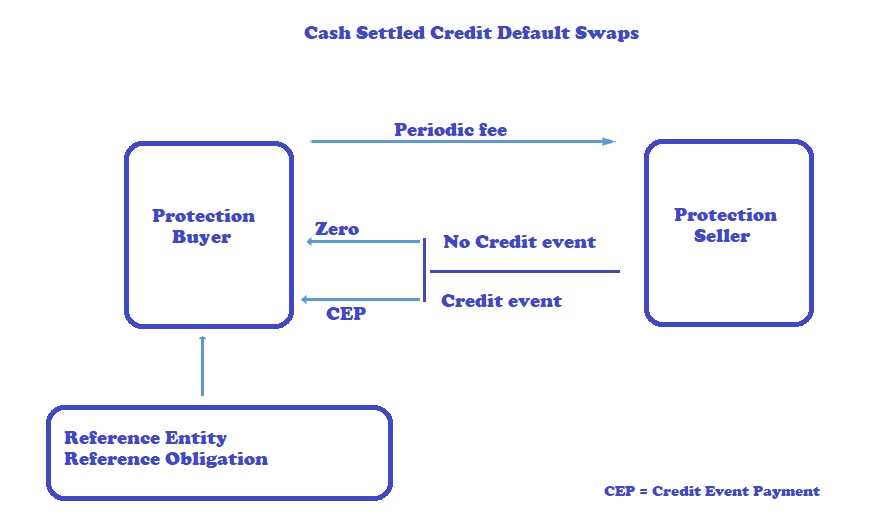

If a Credit Event occurs and cash settlement applies; the transaction shall accelerate and Protection Seller shall pay to Protection Buyer the excess of the par value of the Deliverable Obligations on start date over the prevailing market value of the Deliverable Obligations upon occurrence of the Credit Event.

The procedure for determining market value of Deliverable Obligations is based on ISDA definitions or may be defined in the related confirmation and some cases a pre-determined amount agreed by both parties on inception of the transaction is paid.

Physically Settled Credit Default Swap:

Cash Settled Credit Default Swap:

(B) Credit Default Option:

It is a similar to CDS (kind of CDS) where the fee is paid fully in advance.