Return is the numerical measure of performance. Investments are always done in respect to returns that one expects. The returns could be fixed or floating (unpredictable) in nature.

Return represents the increase in the investor’s wealth that results from making the investment. In the case of stocks, the return is the percentage change in price plus the dividend yield.

One fundamental feature of any investor is their desire to increase their wealth. This translates into obtaining the highest return possible – BUT with increase return we also have increase in risk. Risk is the uncertainty of future returns. We have in the financial market risk-less instruments also – but only with limited returns possible. As the return on investments increases the level of risk also goes high. One has to match his / her risk profile with the investments he / she desires.

Fortunately, the competitive nature of financial and derivative markets enables the investors to identify investments by their degrees of risk.

The prices of securities will reflect the differences in the companies’ risk levels. The additional return one expects to earn from assuming risk is the risk premium.

Consider a hypothetical company with no risk. Will people be willing to invest in this company if they expect no return? Certainly not! They will require a minimum return that will be sufficient to compensate them for giving up the opportunity to spend their money today. This return is called risk-free rate and is the investment’s opportunity cost.

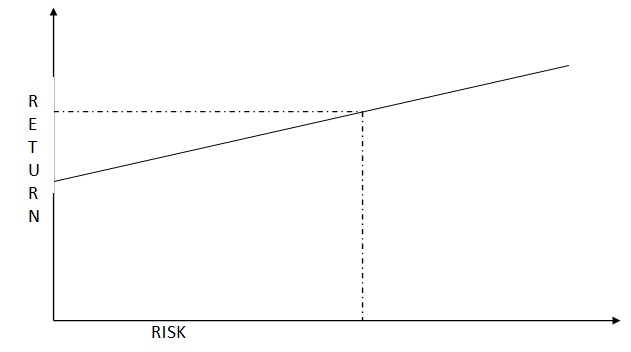

The return investors expect is a combination of risk-free rate and the risk premium. This relationship is illustrated in the figure below, where E (rs) is the expected return on spot asset, r is the risk-free rate, and E (ø) is the risk premium – the excess of expected return over the risk-free rate.

Note that we have not identified how risk is measured. You might recall risk measures such as standard deviation and beta. At this point, we need not be concerned with specific measure of risk. The important point is the positive relationship between risk and return known as risk-return trade-off.

This trade-off arises as all the investors want to maximize their return subject to minimum level of risk. One has to find a suitable level of risk-return to match ones desire.

If a stock price moves up the line into a higher risk level, some investors may find it too risky and may sell off the stock; this will drive its price down. New investors may find it suitable to match their risk profile. Markets that do a good job of pricing the instruments trading therein are said to be efficient and the assets are said to be priced at their theoretical fair value.