Financial Market consists of

- Different types of markets (debt market, equity market, money market, etc..)

- Intermediaries

- Investors (Those who buy or sell)

- Regulatory Markets (SEBI, RBI, etc.)

- Issuers of securities

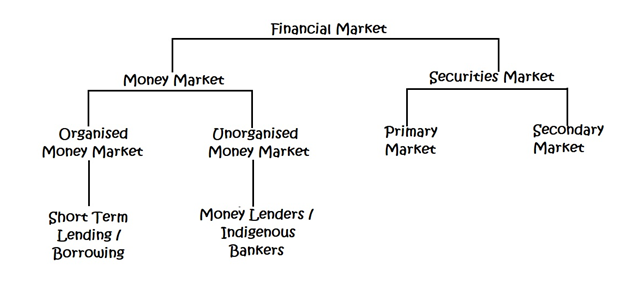

The various components of Indian Financial Markets can be illustrated through the following simple diagram:

The economic development of any country depends on the existence and growth of its well organized financial system. The major assets traded in the financial system are money and monetary assets. An efficient functioning of the financial system facilitates the free flow of funds to more productive activities and thus promotes investment. Thus, the financial system provides the intermediation between savers and investors to promote faster economic development.

The Securities markets provide a regulated framework for an efficient flow of capital (Debt and equity) from investors to various business houses. It is a systematic channel for allocation of savings to investments – not to forget the ‘risk’ element. The savings are channelized through the medium of Securities market to fund the capital requirements of business houses – it may be for expansion, normal day to day operations, acquisition of new businesses, new product launches, new markets, etc.

The term “Securities” has been defined in Section 2 (h) of the Securities Contract (Regulation) Act 1956. The Act defines securities to include:

- Shares, scripts, stocks, bonds, debentures, debenture stock, or other marketable securities of a like nature in or of any incorporated company or other body corporate;

- Derivative;

- units or any other instrument issued by any collective investment scheme to the investors in such schemes;

- security receipt as defined in clause (zg) of section 2 of the Securitisation andReconstruction of Financial Assets and Enforcement of Security Interest Act, 2002;

- units or any other such instrument issued to the investors under any mutual fund scheme (securities do not include any unit linked insurance policy or scripts or any such instrument or unit, by whatever name called which provides a combined benefit risk on the life of the persons and investment by such persons and issued by an insurer refer to in clause (9) of section 2 of the Insurance Act, 1938(4 of 1938)

- any certificate or instrument (by whatever name called), issued to an investor by any issuer being a special purpose distinct entity which possesses any debt or receivable, including mortgage debt, assigned to such entity, and acknowledging beneficial interest of such investor in such debt or receivable, including mortgage debt, as the case maybe;

- government securities;

- such other instruments as may be declared by the Central Government to be securities (including onshore rupee bonds issued by multilateral institutions like the Asian Development Bank and the International Finance Corporation);

- rights or interest in securities.