Treasury Management (or Treasury Operations) includes management of an organization’s cash (and bank balance), with the ultimate goal of maximizing the firm’s liquidity, minimizing idle cash balance and mitigating its operational, financial and reputational risk.

Treasury Management includes a firm’s collections, disbursements, concentration, investment and funding activities.

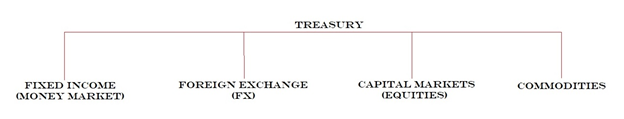

In larger firms, it may also include trading in bonds, currencies, financial derivatives and the associated financial risk management.

All banks have full-fledge department devoted to treasury management and supporting their clients’ needs in this area. However, small banks are increasingly launching and/or expanding their treasury management functions and offerings, because of the market opportunity available

For non-banking entities, the terms Treasury Management and Cash Management are sometimes used interchangeably, while in fact, the scope of treasury management is larger (and includes funding and investment activities mentioned above).

In general, a company’s treasury operations come under the control of the CFO, Vice-President / Director of Finance or Treasurer, and are handled on a day to day basis by the organization’s treasury staff, controller, or comptroller.

In addition to the above, the Treasury function may also have a Proprietary Trading desk that conducts trading activities for the bank’s own account and capital, an Asset liability management (ALM) desk that manages the risk of interest rate mismatch and liquidity; and a Transfer pricing within the bank.

Treasury management has always been a very critical and important function in any organization. A department which is close to CEOs heart. Most profits come from this department. If the risk is not managed adequately, banks could not only make losses, but could also shut down (we shall look at a few cases which have gone that road – few due to frauds and few due to lack of adequate control points.