Derivatives markets can be exchange traded or Over-the-counter (OTC) market. Interbank market is primarily an OTC market.

The exchange traded derivatives started in India in June 2000 with SEBI permitting BSE and NSE to introduce equity derivative segment. To begin with, SEBI approved trading in index futures contracts based on NIFTY and SENSEX, which commenced trading in June 2000.

Later, trading in index options commenced in June 2001 and trading in options started in November 2001. MCX-SX (renamed as MSEI) started trading in all these products in Feb 2013.

In the markets for assets – purchases and sales require that the underlying good or security be delivered either immediately or shortly thereafter.

Payment usually is made immediately, although credit arrangements are sometimes used. Because of these characteristics, we refer to those markets as cashmarkets or spotmarkets.

The sale is made, the payment is remitted, and the good or security is delivered.

In other situations, the good or security is to be delivered at a later date. Still other types of arrangements let the buyer or the seller choose whether or not to go through with the sale. These types of arrangements are conducted in derivative markets.

In contrast to the markets for assets, derivative markets are markets for contractual instruments whose performance is determined by how another instrument or asset performs.

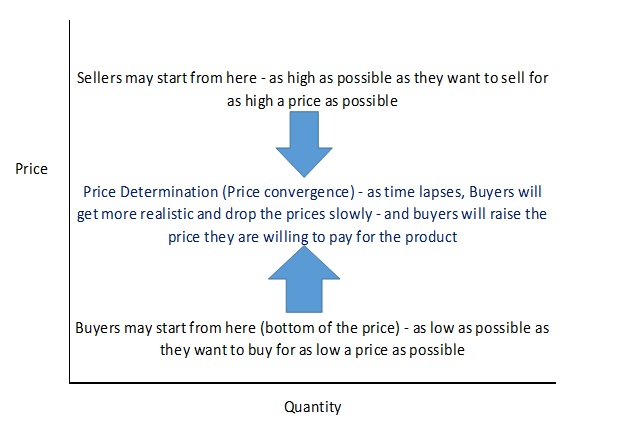

Notice that we referred to derivatives as contracts. Like all contracts, they are agreements between two parties – a buyer and a seller – in which each party does something for the other. These contracts have a price, and buyers try to buy as cheaply as possible while sellers try to sell as dearly as possible.

This section briefly introduces the various types of derivative contracts: Options, forward contracts, futures contracts, and swaps and related derivatives.

In an open market where the price is determined by Demand and Supply and not a regulated price. It is determined as follows: