Primary market is for Securities to be issued for the first time by theOrganisation. The primary market is concerned with first time issuance. When shares are issued for the first time, it is also known as ‘going public’. By the way of issuing new shares, the firms is raising funds for them – either for their expansion or any other plans that they may have. The Merchant banking division of a commercial bank is usually involved for such issuances advisory.

IPO: Initial Public Offering.

Initial public offering (IPO) or stock market launch is a type of public offering in which shares of a company are sold for the first time. Through this process, a privately held company transforms into a public company. Initial public offerings are mostly used by companies to raise the expansion of capital, possibly to monetize the investments of early private investors, and to become publicly traded enterprises. A company selling shares is never required to repay the capital to its public investors. After the IPO, when shares trade freely in the open market, money passes between public investors. The IPO process is colloquially known as going public.

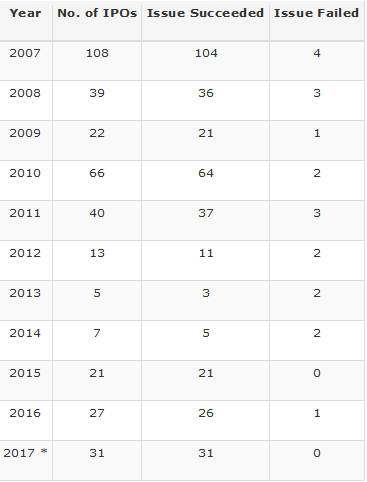

The total amount of capital raised through equity issues in 2009-10 was Rs. 46,736 crore as against Rs. 2,082 crore in 2008-09. Due to global financial crisis in 2008, the primary capital market received a setback in 2008-09. The number of new issues declined sharply in 2008-09.

Total amount of capital raised through equity issues during 2010-11 was Rs. 48,654 crore. The total number of initial public offerings (IPOs) in 2010-11 was only 55 as against 85 in 2007-08 and 39 in 2009-10. The amount mobilized by IPOs in 2010-11 was Rs. 35,569 as against Rs. 24,696 crore in the whole year 2009-10.

Number of IPOS in 2015: 21

Number of IPOs in 2016: 27

IPO: Success Vs. failures