We expect that the spot price of an asset converges to that of the futures price as the delivery date of the contract approaches otherwise an arbitrage opportunity exists.

If the future price stays above the spot price, once can buy the asset now and short a futures contract (i.e. agree to sell the asset later at the future price). Then we deliver and book a profit.

If the futures price stays below the spot price, anyone who wants the asset should go long on the futures contract and accept delivery instead of paying the spot price. This will be a profitable situation.

Let’s have a look at how futures contract is priced.

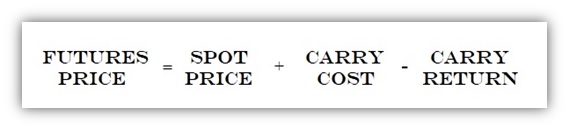

Cost of carry Model:

Cost-of-carry model is an arbitrage-free pricing model.

Carry Cost is the cost incurred to keep that asset under our possession till the maturity date. This is an outflow (negative flow / negative returns)

Carry Return is any return that we receive when we have the asset under our possession till maturity date. This is an inflow (positive flow / positive returns)

Example: Dividends declared while the security is under our possession.

Thus the futures price is equal to Spot price plus any carry cost incurred minus any returns received from that security under possession called carry return. If this is not so, there will be arbitrage opportunity in the market (Difference in price in the futures markets and price in the spot market)