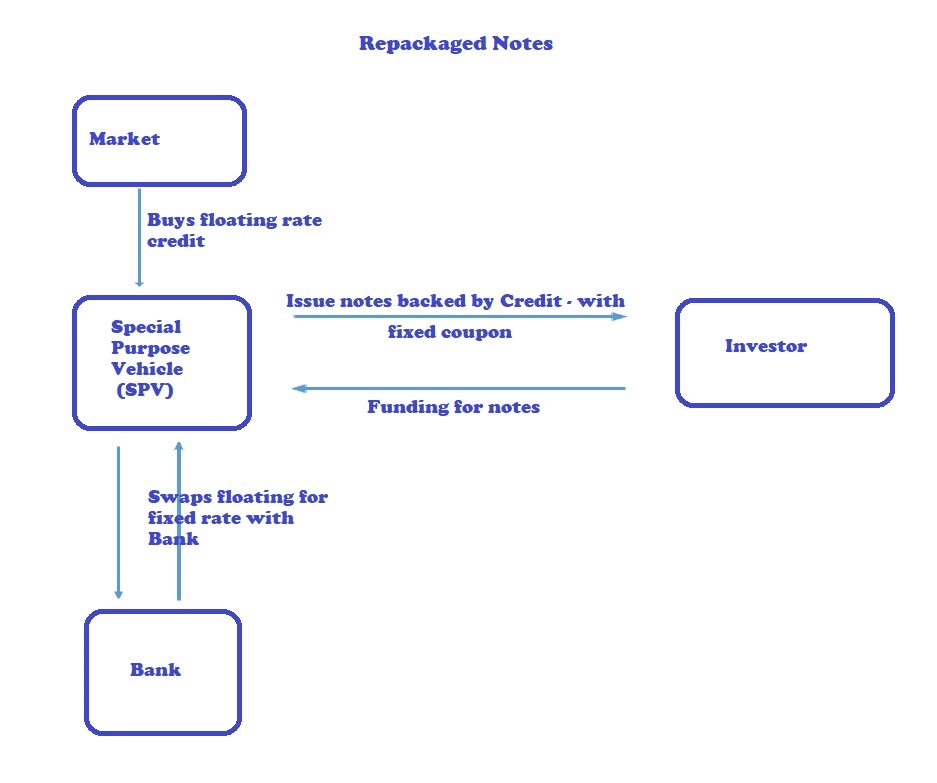

Repackaging involves placing securities and derivatives in a Special Purpose Vehicle (SPV) which then issues customized notes that are backed by the instruments placed. The difference between repackaged notes and CLDs (Credit Linked Deposits) is that while CLDs are default swaps embedded in deposits/notes, repackaged notes are issued against collateral – which typically would include cash collateral (bonds / loans / cash) and derivative contracts. Another feature of Repackaged Notes is that any issue by the SPV has recourse only to the collateral of that issue.