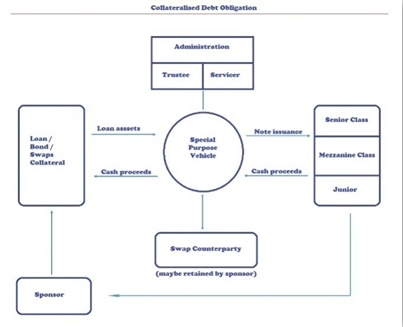

CDOs are specialized repackaged offerings that typically involve a large portfolio of credits. Both involve issuance of debt by a SPV based on collateral of underlying credit(s). The essential difference between a repackaging program and a CDO is that while a simple repackaging usually delivers the entire risk inherent in the underlying collateral (securities and derivatives) to the investor, a CDO involves a horizontal splitting of that risk and categorizing investors into senior class debt, mezzanine class and a junior debt. CDOs may be further categorized, based on the structure with which funding is raised. The funding could be raised by issuing bonds, which are called Collateralised Bond Obligations (CBOs) or by raising loans, which are called Collateralised Loan Obligations (CLOs).

A CDO looks like this: (diagram below):