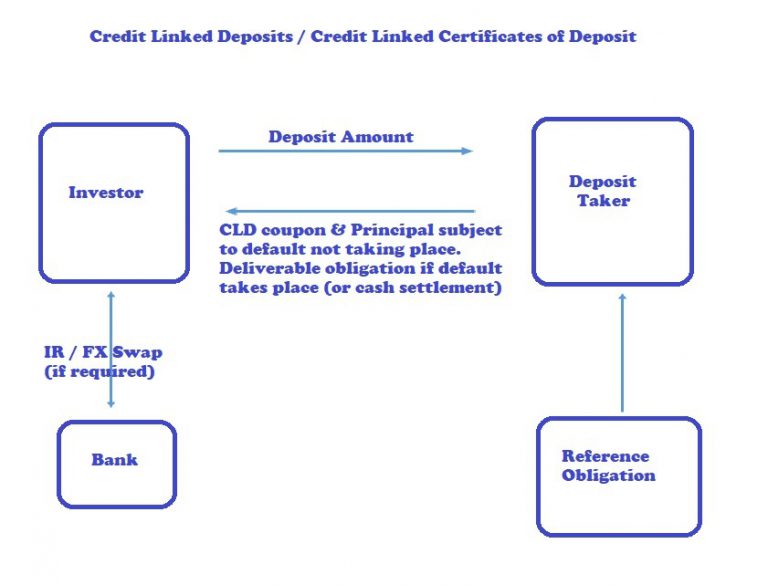

Credit Linked Deposits (CLDs) are structured deposits with embedded default swaps. Conceptually they can be thought of as deposits along with a default swap that the investor sells to the deposit taker. The default contingency can be based on a variety of underlying assets, including a specific corporate loan or security, a portfolio of loans or securities or sovereign debt instruments, or even a portfolio of contracts which give rise to credit exposure. If necessary, the structure can include an interest rate or foreign exchange swap to create cash flows required by investor. In effect, the depositor is selling protection on the reference obligation and earning a premium in the form of a yield spread over plain deposits. If a credit event occurs during the tenure of the CLD, the deposit is paid and the investor would get the Deliverable Obligation instead of the Deposit Amount.

The below figure is of a simple CLD structure.